Unfortunately for some shareholders, the Xiamen King Long Motor Group Co., Ltd. (SHSE:600686) share price has dived 29% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 19% share price drop.

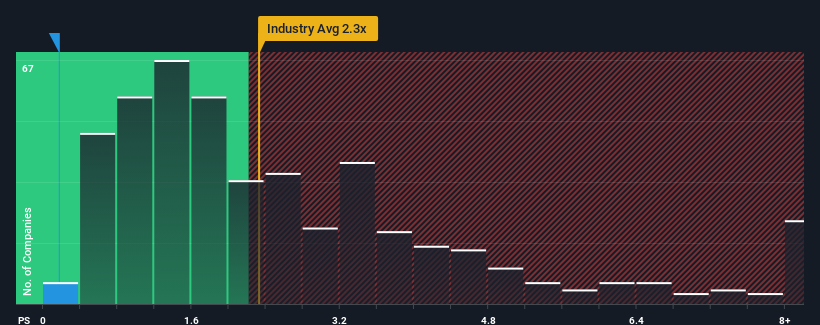

After such a large drop in price, when around half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") above 2.3x, you may consider Xiamen King Long Motor Group as an incredibly enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Xiamen King Long Motor Group's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Xiamen King Long Motor Group has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for Xiamen King Long Motor Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Xiamen King Long Motor Group's to be considered reasonable.

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Xiamen King Long Motor Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. The latest three year period has also seen an excellent 47% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

In light of this, it's understandable that Xiamen King Long Motor Group's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Xiamen King Long Motor Group's P/S?

Shares in Xiamen King Long Motor Group have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Xiamen King Long Motor Group maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Xiamen King Long Motor Group (1 makes us a bit uncomfortable!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.