Shaanxi Jinye Science Technology and Education Group Co.,Ltd (SZSE:000812) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

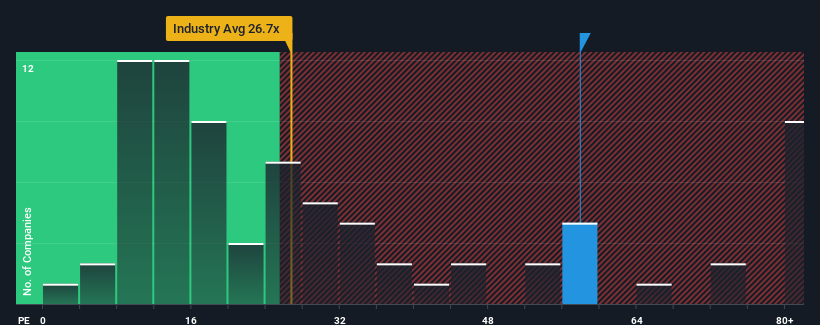

In spite of the heavy fall in price, Shaanxi Jinye Science Technology and Education GroupLtd's price-to-earnings (or "P/E") ratio of 57.9x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 26x and even P/E's below 16x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Shaanxi Jinye Science Technology and Education GroupLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

How Is Shaanxi Jinye Science Technology and Education GroupLtd's Growth Trending?

In order to justify its P/E ratio, Shaanxi Jinye Science Technology and Education GroupLtd would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 34%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 418% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 41% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Shaanxi Jinye Science Technology and Education GroupLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Shaanxi Jinye Science Technology and Education GroupLtd's P/E

A significant share price dive has done very little to deflate Shaanxi Jinye Science Technology and Education GroupLtd's very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shaanxi Jinye Science Technology and Education GroupLtd revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shaanxi Jinye Science Technology and Education GroupLtd (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If you're unsure about the strength of Shaanxi Jinye Science Technology and Education GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.