The Jiangsu Changqing Agrochemical Co., Ltd. (SZSE:002391) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

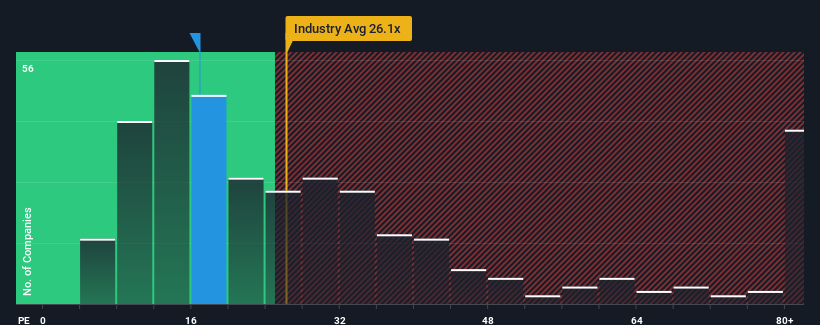

Since its price has dipped substantially, Jiangsu Changqing Agrochemical may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.9x, since almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 48x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Jiangsu Changqing Agrochemical has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is Jiangsu Changqing Agrochemical's Growth Trending?

In order to justify its P/E ratio, Jiangsu Changqing Agrochemical would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Jiangsu Changqing Agrochemical would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. As a result, earnings from three years ago have also fallen 46% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 92% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we find it odd that Jiangsu Changqing Agrochemical is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Jiangsu Changqing Agrochemical's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangsu Changqing Agrochemical currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Jiangsu Changqing Agrochemical you should be aware of.

You might be able to find a better investment than Jiangsu Changqing Agrochemical. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.