Jikai Equipment Manufacturing Co., Ltd. (SZSE:002691) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

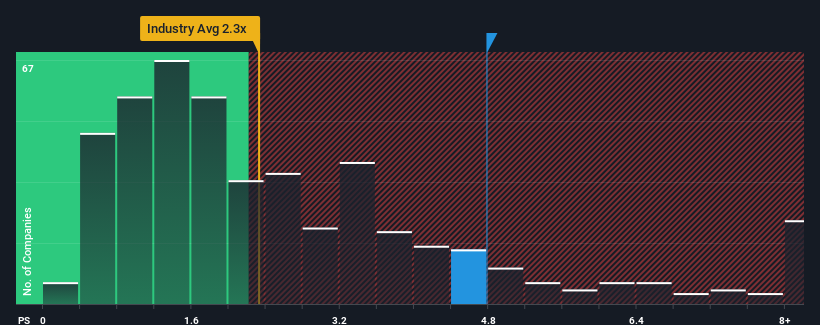

Even after such a large drop in price, you could still be forgiven for thinking Jikai Equipment Manufacturing is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.8x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Jikai Equipment Manufacturing's Recent Performance Look Like?

Jikai Equipment Manufacturing has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jikai Equipment Manufacturing's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Jikai Equipment Manufacturing would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Jikai Equipment Manufacturing would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen a 24% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 27% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Jikai Equipment Manufacturing's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Jikai Equipment Manufacturing's P/S

A significant share price dive has done very little to deflate Jikai Equipment Manufacturing's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Jikai Equipment Manufacturing currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 2 warning signs for Jikai Equipment Manufacturing (1 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Jikai Equipment Manufacturing, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.