The Zhejiang Giuseppe Garment Co., Ltd (SZSE:002687) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

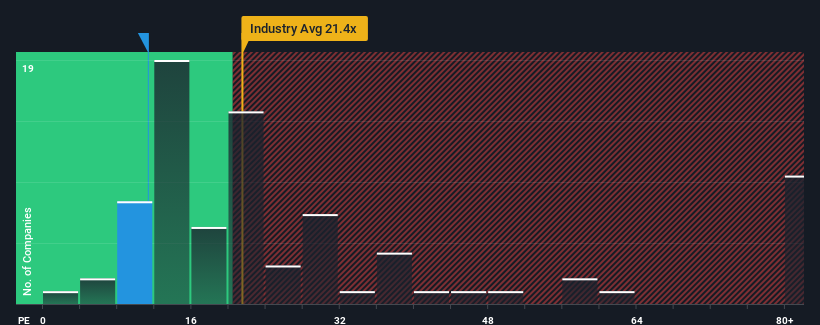

Although its price has dipped substantially, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 25x, you may still consider Zhejiang Giuseppe Garment as a highly attractive investment with its 11.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Zhejiang Giuseppe Garment as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Zhejiang Giuseppe Garment's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.8% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 30% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 52% over the next year. With the market only predicted to deliver 42%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Zhejiang Giuseppe Garment's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Shares in Zhejiang Giuseppe Garment have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Zhejiang Giuseppe Garment's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhejiang Giuseppe Garment you should know about.

You might be able to find a better investment than Zhejiang Giuseppe Garment. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.