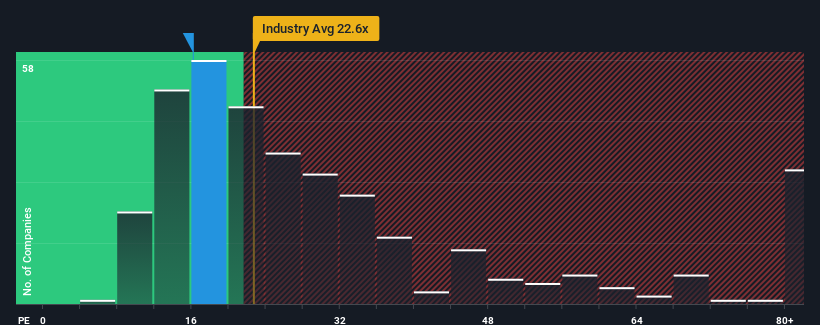

With a price-to-earnings (or "P/E") ratio of 16.2x Inner Mongolia First Machinery Group Co.,Ltd. (SHSE:600967) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 25x and even P/E's higher than 44x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Inner Mongolia First Machinery GroupLtd's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

Does Growth Match The Low P/E?

Inner Mongolia First Machinery GroupLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 1.6% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 30% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Retrospectively, the last year delivered a frustrating 1.6% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 30% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 30% during the coming year according to the only analyst following the company. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Inner Mongolia First Machinery GroupLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Inner Mongolia First Machinery GroupLtd's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Inner Mongolia First Machinery GroupLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Inner Mongolia First Machinery GroupLtd (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.