Suzhou Longjie Special Fiber Co., Ltd. (SHSE:603332) shareholders that were waiting for something to happen have been dealt a blow with a 49% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

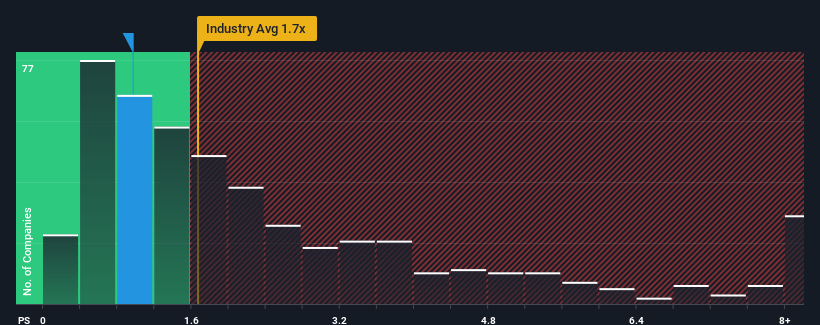

Since its price has dipped substantially, Suzhou Longjie Special Fiber's price-to-sales (or "P/S") ratio of 1x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Suzhou Longjie Special Fiber Has Been Performing

Revenue has risen firmly for Suzhou Longjie Special Fiber recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Suzhou Longjie Special Fiber will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Suzhou Longjie Special Fiber will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Suzhou Longjie Special Fiber?

The only time you'd be truly comfortable seeing a P/S as low as Suzhou Longjie Special Fiber's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Suzhou Longjie Special Fiber's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The latest three year period has also seen an excellent 44% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this information, we can see why Suzhou Longjie Special Fiber is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

Suzhou Longjie Special Fiber's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, Suzhou Longjie Special Fiber maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you take the next step, you should know about the 3 warning signs for Suzhou Longjie Special Fiber that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.