The last three months have been tough on Suzhou Sunmun Technology Co., Ltd. (SZSE:300522) shareholders, who have seen the share price decline a rather worrying 35%. But that doesn't change the fact that the returns over the last five years have been pleasing. Its return of 45% has certainly bested the market return!

Since it's been a strong week for Suzhou Sunmun Technology shareholders, let's have a look at trend of the longer term fundamentals.

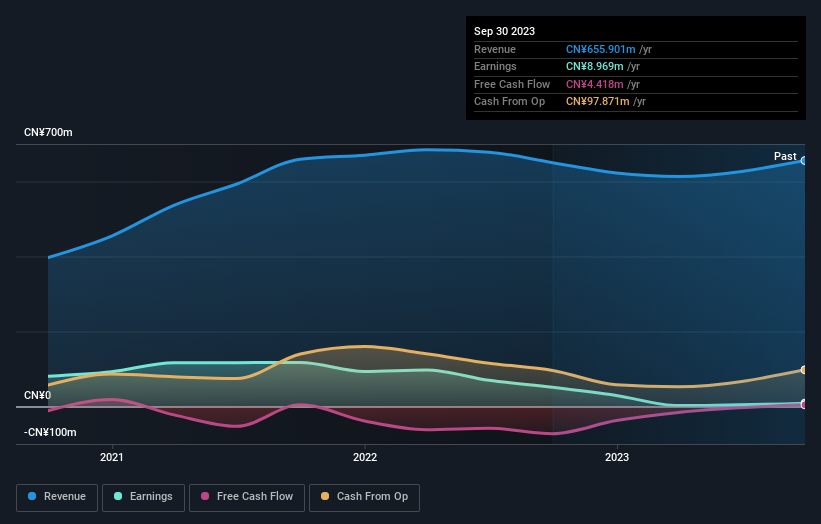

Given that Suzhou Sunmun Technology only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Suzhou Sunmun Technology saw its revenue grow at 18% per year. That's well above most pre-profit companies. It's good to see that the stock has 8%, but not entirely surprising given revenue shows strong growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

In the last 5 years Suzhou Sunmun Technology saw its revenue grow at 18% per year. That's well above most pre-profit companies. It's good to see that the stock has 8%, but not entirely surprising given revenue shows strong growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Suzhou Sunmun Technology stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Suzhou Sunmun Technology the TSR over the last 5 years was 53%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's certainly disappointing to see that Suzhou Sunmun Technology shares lost 5.4% throughout the year, that wasn't as bad as the market loss of 20%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 9% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Suzhou Sunmun Technology has 4 warning signs (and 2 which can't be ignored) we think you should know about.

Of course Suzhou Sunmun Technology may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.