Some Targa Resources Corp. (NYSE:TRGP) shareholders may be a little concerned to see that the Chief Financial Officer, Jennifer Kneale, recently sold a substantial US$2.5m worth of stock at a price of US$97.36 per share. That sale reduced their total holding by 10% which is hardly insignificant, but far from the worst we've seen.

The Last 12 Months Of Insider Transactions At Targa Resources

In fact, the recent sale by Jennifer Kneale was the biggest sale of Targa Resources shares made by an insider individual in the last twelve months, according to our records. So what is clear is that an insider saw fit to sell at around the current price of US$97.03. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

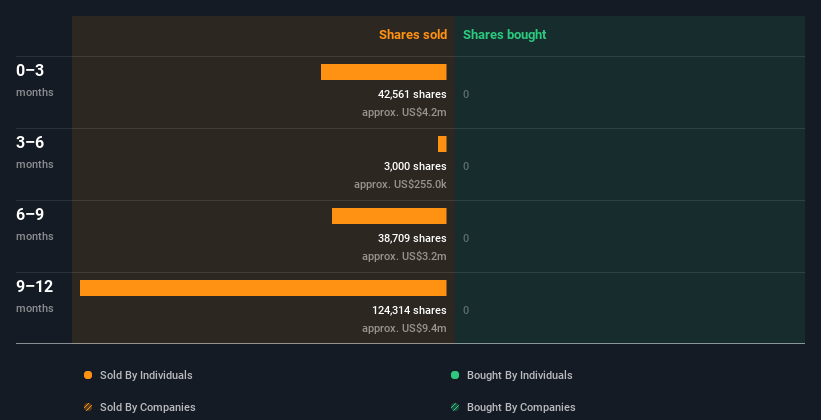

Insiders in Targa Resources didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership Of Targa Resources

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Targa Resources insiders own 1.8% of the company, worth about US$401m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Targa Resources Tell Us?

Insiders sold Targa Resources shares recently, but they didn't buy any. Looking to the last twelve months, our data doesn't show any insider buying. It is good to see high insider ownership, but the insider selling leaves us cautious. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. While conducting our analysis, we found that Targa Resources has 3 warning signs and it would be unwise to ignore these.

But note: Targa Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.