Guang Dong Qun Xing Toys Joint-Stockco.,Ltd. (SZSE:002575) shareholders have seen the share price descend 14% over the month. But over three years, the returns would have left most investors smiling To wit, the share price did better than an index fund, climbing 52% during that period.

Since the stock has added CN¥591m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

While Guang Dong Qun Xing Toys co.Ltd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years Guang Dong Qun Xing Toys co.Ltd saw its revenue shrink by 7.0% per year. Despite the lack of revenue growth, the stock has returned 15%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

In the last 3 years Guang Dong Qun Xing Toys co.Ltd saw its revenue shrink by 7.0% per year. Despite the lack of revenue growth, the stock has returned 15%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

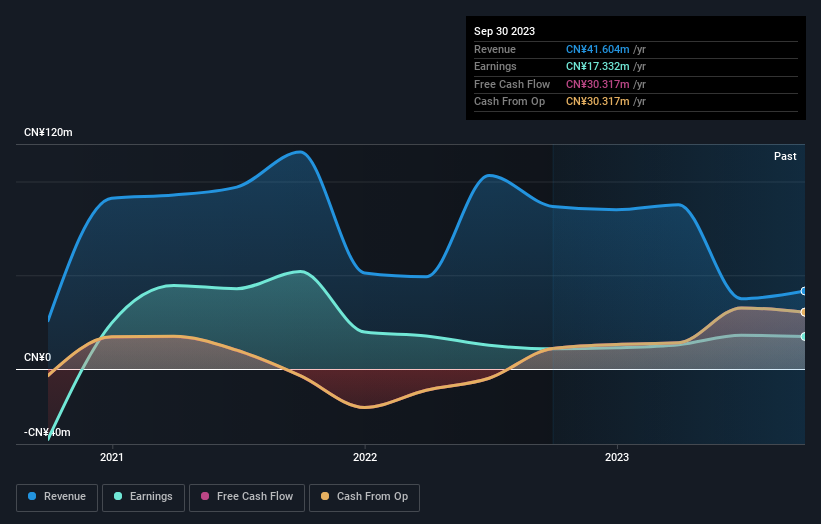

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Guang Dong Qun Xing Toys co.Ltd shareholders are down 16% over twelve months, which isn't far from the market return of -17%. Unfortunately, last year's performance is a deterioration of an already poor long term track record, given the loss of 7% per year over the last five years. Weak performance over the long term usually destroys market confidence in a stock, but bargain hunters may want to take a closer look for signs of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Guang Dong Qun Xing Toys co.Ltd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Guang Dong Qun Xing Toys co.Ltd , and understanding them should be part of your investment process.

Of course Guang Dong Qun Xing Toys co.Ltd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.