David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Smartsens Technology (Shanghai) Co., Ltd. (SHSE:688213) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Smartsens Technology (Shanghai)'s Debt?

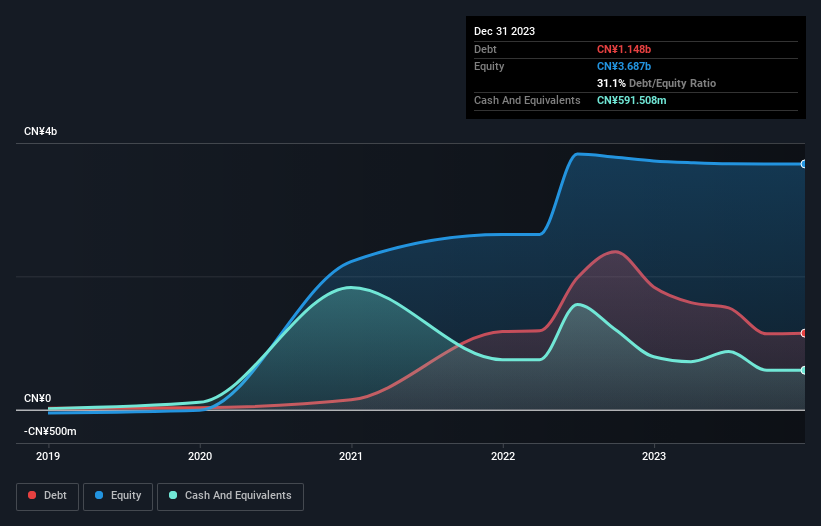

You can click the graphic below for the historical numbers, but it shows that Smartsens Technology (Shanghai) had CN¥1.15b of debt in September 2023, down from CN¥1.84b, one year before. However, it also had CN¥591.5m in cash, and so its net debt is CN¥556.5m.

How Healthy Is Smartsens Technology (Shanghai)'s Balance Sheet?

The latest balance sheet data shows that Smartsens Technology (Shanghai) had liabilities of CN¥1.38b due within a year, and liabilities of CN¥327.2m falling due after that. Offsetting this, it had CN¥591.5m in cash and CN¥819.9m in receivables that were due within 12 months. So its liabilities total CN¥296.8m more than the combination of its cash and short-term receivables.

The latest balance sheet data shows that Smartsens Technology (Shanghai) had liabilities of CN¥1.38b due within a year, and liabilities of CN¥327.2m falling due after that. Offsetting this, it had CN¥591.5m in cash and CN¥819.9m in receivables that were due within 12 months. So its liabilities total CN¥296.8m more than the combination of its cash and short-term receivables.

This state of affairs indicates that Smartsens Technology (Shanghai)'s balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CN¥17.2b company is short on cash, but still worth keeping an eye on the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Smartsens Technology (Shanghai) can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Smartsens Technology (Shanghai) wasn't profitable at an EBIT level, but managed to grow its revenue by 15%, to CN¥2.9b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Smartsens Technology (Shanghai) had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost CN¥23m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of CN¥683m and the profit of CN¥14m. So one might argue that there's still a chance it can get things on the right track. For riskier companies like Smartsens Technology (Shanghai) I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.