While Zhaojin Mining Industry Company Limited (HKG:1818) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. But that doesn't change the fact that the returns over the last three years have been pleasing. In the last three years the share price is up, 15%: better than the market.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last three years, Zhaojin Mining Industry failed to grow earnings per share, which fell 16% (annualized).

Over the last three years, Zhaojin Mining Industry failed to grow earnings per share, which fell 16% (annualized).

The strong decline in earnings per share suggests the market isn't using EPS to judge the company. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Languishing at just 0.5%, we doubt the dividend is doing much to prop up the share price. We severely doubt anyone is particularly impressed with the modest 2.8% three-year revenue growth rate. So truth be told we can't see an easy explanation for the share price action, but perhaps you can...

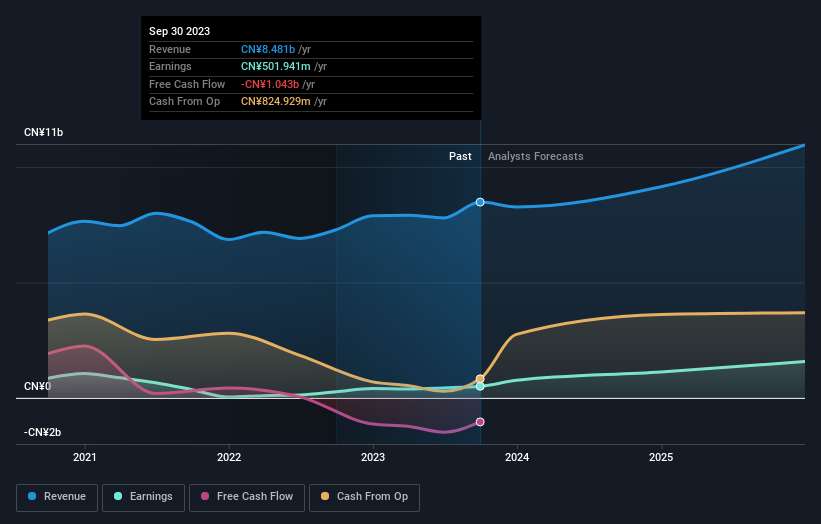

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Zhaojin Mining Industry has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Zhaojin Mining Industry will earn in the future (free profit forecasts).

A Different Perspective

While it's never nice to take a loss, Zhaojin Mining Industry shareholders can take comfort that , including dividends,their trailing twelve month loss of 1.0% wasn't as bad as the market loss of around 11%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 1.5% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Zhaojin Mining Industry better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Zhaojin Mining Industry .

Of course Zhaojin Mining Industry may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.