Jiangsu Kuangshun Photosensitivity New-Material Stock Co., Ltd. (SZSE:300537) shareholders are no doubt pleased to see that the share price has bounced 40% in the last month, although it is still struggling to make up recently lost ground. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

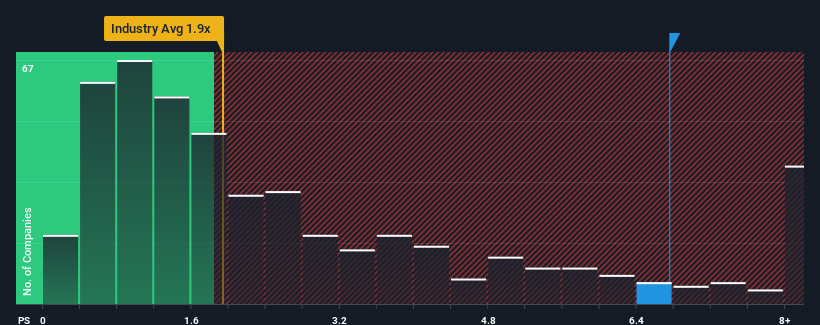

Following the firm bounce in price, you could be forgiven for thinking Jiangsu Kuangshun Photosensitivity New-Material Stock is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.8x, considering almost half the companies in China's Chemicals industry have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Jiangsu Kuangshun Photosensitivity New-Material Stock's P/S Mean For Shareholders?

Jiangsu Kuangshun Photosensitivity New-Material Stock could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiangsu Kuangshun Photosensitivity New-Material Stock.Is There Enough Revenue Growth Forecasted For Jiangsu Kuangshun Photosensitivity New-Material Stock?

In order to justify its P/S ratio, Jiangsu Kuangshun Photosensitivity New-Material Stock would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Jiangsu Kuangshun Photosensitivity New-Material Stock would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 55% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Jiangsu Kuangshun Photosensitivity New-Material Stock's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Jiangsu Kuangshun Photosensitivity New-Material Stock's P/S Mean For Investors?

Shares in Jiangsu Kuangshun Photosensitivity New-Material Stock have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Jiangsu Kuangshun Photosensitivity New-Material Stock's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Jiangsu Kuangshun Photosensitivity New-Material Stock that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.