Those holding Zhaojin Mining Industry Company Limited (HKG:1818) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

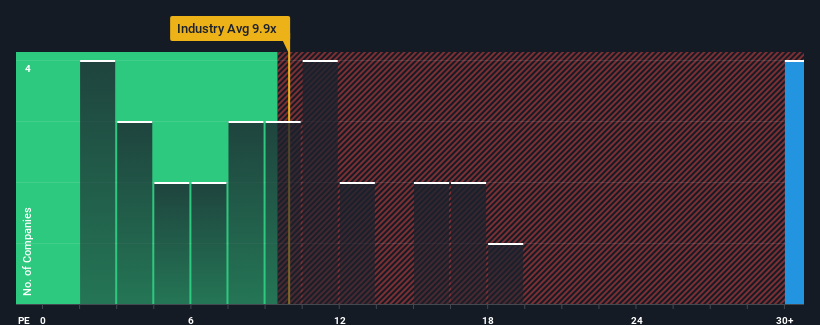

Since its price has surged higher, Zhaojin Mining Industry may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 55.3x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 4x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been pleasing for Zhaojin Mining Industry as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

Zhaojin Mining Industry's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Zhaojin Mining Industry's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 82% last year. Still, incredibly EPS has fallen 41% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 108% as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 23%, which is noticeably less attractive.

In light of this, it's understandable that Zhaojin Mining Industry's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Zhaojin Mining Industry have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Zhaojin Mining Industry maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhaojin Mining Industry you should know about.

If these risks are making you reconsider your opinion on Zhaojin Mining Industry, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.