Shenyang Fortune Precision Equipment Co., Ltd. (SHSE:688409) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 47% in the last twelve months.

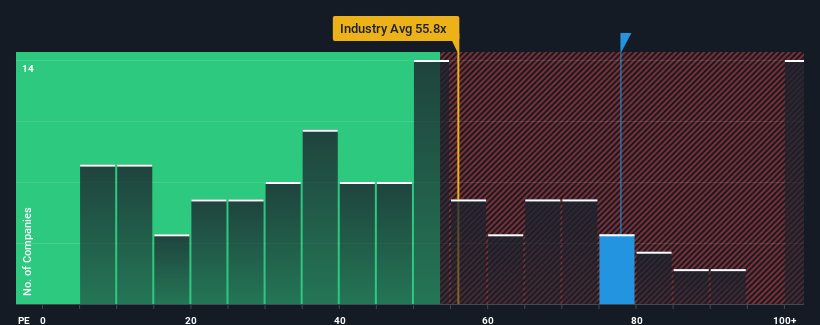

Following the firm bounce in price, Shenyang Fortune Precision Equipment's price-to-earnings (or "P/E") ratio of 77.8x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Shenyang Fortune Precision Equipment as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For Shenyang Fortune Precision Equipment?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shenyang Fortune Precision Equipment's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shenyang Fortune Precision Equipment's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 133% as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we can see why Shenyang Fortune Precision Equipment is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shenyang Fortune Precision Equipment's P/E?

Shares in Shenyang Fortune Precision Equipment have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shenyang Fortune Precision Equipment maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shenyang Fortune Precision Equipment that you should be aware of.

Of course, you might also be able to find a better stock than Shenyang Fortune Precision Equipment. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.