Those holding Funshine Culture Group Co.,Ltd. (SZSE:300860) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

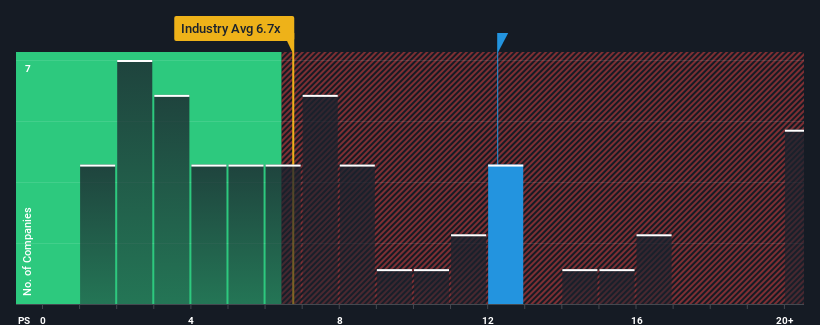

After such a large jump in price, Funshine Culture GroupLtd may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.2x, when you consider almost half of the companies in the Entertainment industry in China have P/S ratios under 6.7x and even P/S lower than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Funshine Culture GroupLtd's Recent Performance Look Like?

Funshine Culture GroupLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Funshine Culture GroupLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Funshine Culture GroupLtd would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Funshine Culture GroupLtd would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 58% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 268% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 34%, which is noticeably less attractive.

With this information, we can see why Funshine Culture GroupLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Funshine Culture GroupLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Funshine Culture GroupLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Funshine Culture GroupLtd has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.