When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Jiangxi Black Cat Carbon Black Inc.,Ltd (SZSE:002068) share price is up 47% in the last 5 years, clearly besting the market return of around 4.7% (ignoring dividends).

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

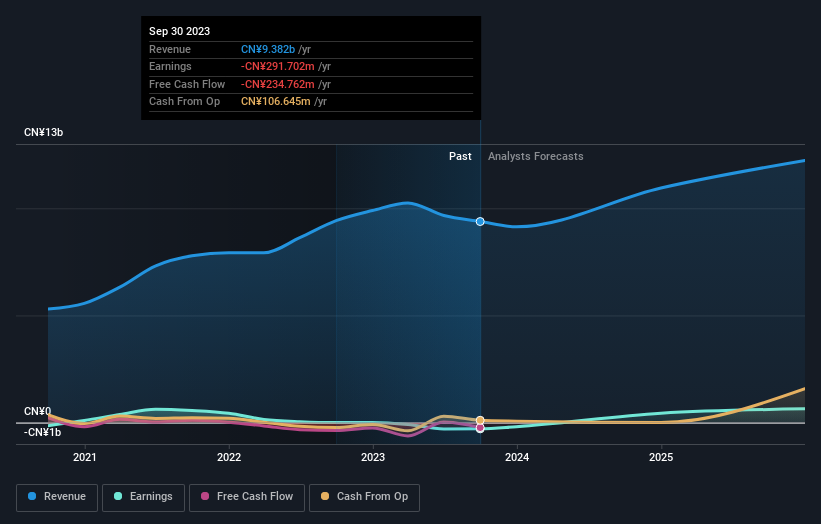

Given that Jiangxi Black Cat Carbon BlackLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Jiangxi Black Cat Carbon BlackLtd can boast revenue growth at a rate of 7.9% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 8% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

For the last half decade, Jiangxi Black Cat Carbon BlackLtd can boast revenue growth at a rate of 7.9% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 8% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Jiangxi Black Cat Carbon BlackLtd

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Jiangxi Black Cat Carbon BlackLtd's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Jiangxi Black Cat Carbon BlackLtd's TSR of 62% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Jiangxi Black Cat Carbon BlackLtd shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 13%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Jiangxi Black Cat Carbon BlackLtd that you should be aware of.

We will like Jiangxi Black Cat Carbon BlackLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.