Those holding Changsha DIALINE New Material Sci.&Tech. Co., Ltd. (SZSE:300700) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

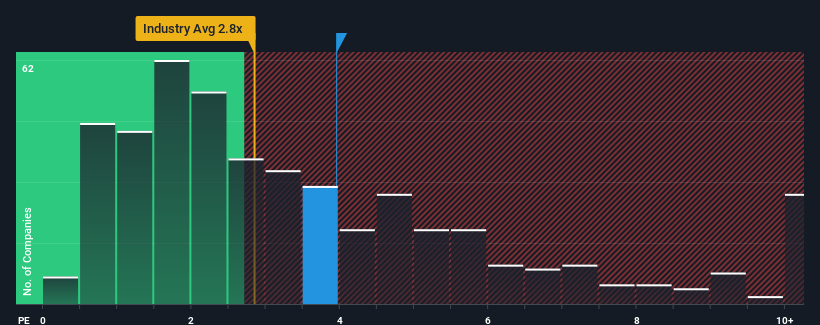

Since its price has surged higher, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Changsha DIALINE New Material Sci.&Tech as a stock probably not worth researching with its 4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Changsha DIALINE New Material Sci.&Tech's P/S Mean For Shareholders?

Recent times have been advantageous for Changsha DIALINE New Material Sci.&Tech as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Changsha DIALINE New Material Sci.&Tech.Is There Enough Revenue Growth Forecasted For Changsha DIALINE New Material Sci.&Tech?

Changsha DIALINE New Material Sci.&Tech's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Changsha DIALINE New Material Sci.&Tech's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 77% gain to the company's top line. Pleasingly, revenue has also lifted 268% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 87% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 28%, which is noticeably less attractive.

In light of this, it's understandable that Changsha DIALINE New Material Sci.&Tech's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Changsha DIALINE New Material Sci.&Tech's P/S?

Changsha DIALINE New Material Sci.&Tech's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Changsha DIALINE New Material Sci.&Tech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Changsha DIALINE New Material Sci.&Tech (1 can't be ignored!) that you should be aware of.

If you're unsure about the strength of Changsha DIALINE New Material Sci.&Tech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.