Zhejiang Youpon Integrated Ceiling Co.,Ltd. (SZSE:002718) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

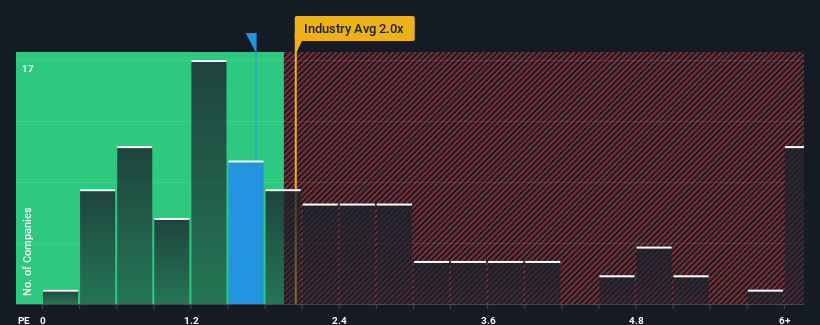

Although its price has surged higher, there still wouldn't be many who think Zhejiang Youpon Integrated CeilingLtd's price-to-sales (or "P/S") ratio of 1.7x is worth a mention when the median P/S in China's Consumer Durables industry is similar at about 2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Zhejiang Youpon Integrated CeilingLtd Performed Recently?

It looks like revenue growth has deserted Zhejiang Youpon Integrated CeilingLtd recently, which is not something to boast about. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhejiang Youpon Integrated CeilingLtd will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Zhejiang Youpon Integrated CeilingLtd?

Zhejiang Youpon Integrated CeilingLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Zhejiang Youpon Integrated CeilingLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Zhejiang Youpon Integrated CeilingLtd's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Zhejiang Youpon Integrated CeilingLtd's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears to us that Zhejiang Youpon Integrated CeilingLtd maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Zhejiang Youpon Integrated CeilingLtd (1 shouldn't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.