Shenzhen Water Planning & Design Institute Co., Ltd. (SZSE:301038) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

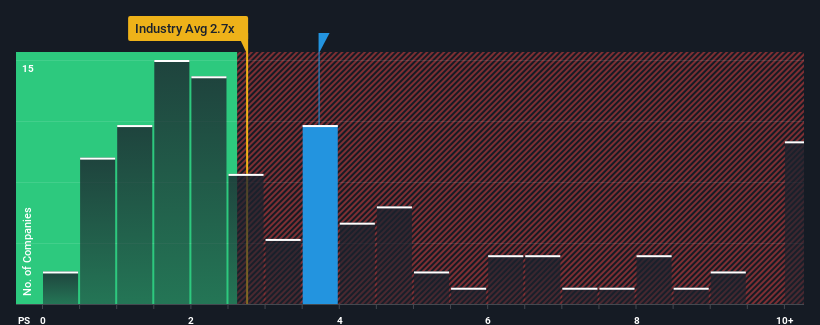

Following the firm bounce in price, when almost half of the companies in China's Commercial Services industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Shenzhen Water Planning & Design Institute as a stock probably not worth researching with its 3.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Shenzhen Water Planning & Design Institute's P/S Mean For Shareholders?

For example, consider that Shenzhen Water Planning & Design Institute's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenzhen Water Planning & Design Institute will help you shine a light on its historical performance.How Is Shenzhen Water Planning & Design Institute's Revenue Growth Trending?

In order to justify its P/S ratio, Shenzhen Water Planning & Design Institute would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Shenzhen Water Planning & Design Institute would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. The last three years don't look nice either as the company has shrunk revenue by 20% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 30% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Shenzhen Water Planning & Design Institute is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Shenzhen Water Planning & Design Institute's P/S

Shenzhen Water Planning & Design Institute's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Water Planning & Design Institute revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

You should always think about risks. Case in point, we've spotted 2 warning signs for Shenzhen Water Planning & Design Institute you should be aware of, and 1 of them makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.