JDM JingDaMachine (Ningbo) Co.Ltd (SHSE:603088) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.8% in the last twelve months.

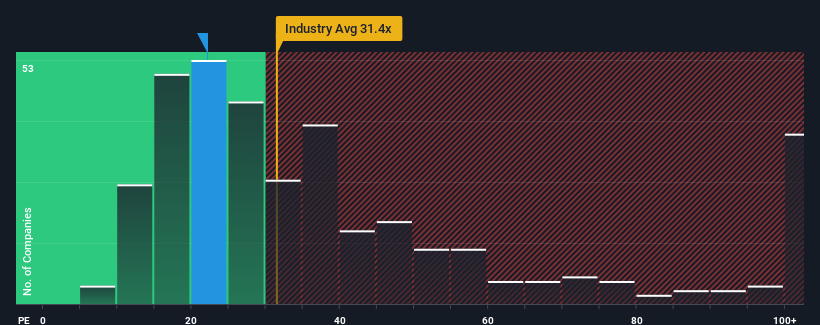

In spite of the firm bounce in price, JDM JingDaMachine (Ningbo)Ltd's price-to-earnings (or "P/E") ratio of 22.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 58x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been pleasing for JDM JingDaMachine (Ningbo)Ltd as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Is There Any Growth For JDM JingDaMachine (Ningbo)Ltd?

The only time you'd be truly comfortable seeing a P/E as low as JDM JingDaMachine (Ningbo)Ltd's is when the company's growth is on track to lag the market.

The only time you'd be truly comfortable seeing a P/E as low as JDM JingDaMachine (Ningbo)Ltd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. Pleasingly, EPS has also lifted 121% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 45% as estimated by the lone analyst watching the company. With the market only predicted to deliver 40%, the company is positioned for a stronger earnings result.

With this information, we find it odd that JDM JingDaMachine (Ningbo)Ltd is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

JDM JingDaMachine (Ningbo)Ltd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that JDM JingDaMachine (Ningbo)Ltd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for JDM JingDaMachine (Ningbo)Ltd that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.