Those holding Wuxi Smart Auto-Control Engineering Co., Ltd. (SZSE:002877) shares would be relieved that the share price has rebounded 48% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.1% in the last twelve months.

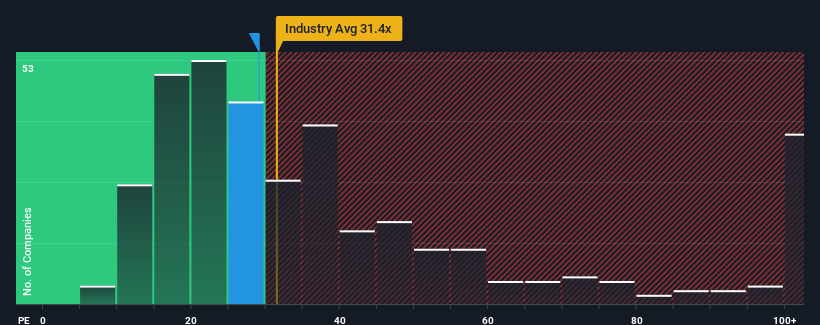

Although its price has surged higher, there still wouldn't be many who think Wuxi Smart Auto-Control Engineering's price-to-earnings (or "P/E") ratio of 29.1x is worth a mention when the median P/E in China is similar at about 31x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Wuxi Smart Auto-Control Engineering has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

How Is Wuxi Smart Auto-Control Engineering's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Wuxi Smart Auto-Control Engineering's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 57% last year. The strong recent performance means it was also able to grow EPS by 120% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 40% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Wuxi Smart Auto-Control Engineering's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Wuxi Smart Auto-Control Engineering's P/E?

Wuxi Smart Auto-Control Engineering's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Wuxi Smart Auto-Control Engineering revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Wuxi Smart Auto-Control Engineering is showing 3 warning signs in our investment analysis, and 2 of those don't sit too well with us.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.