While it may not be enough for some shareholders, we think it is good to see the Shanghai Jinqiao Export Processing Zone Development Co.,Ltd (SHSE:600639) share price up 17% in a single quarter. But if you look at the last five years the returns have not been good. After all, the share price is down 25% in that time, significantly under-performing the market.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

While the share price declined over five years, Shanghai Jinqiao Export Processing Zone DevelopmentLtd actually managed to increase EPS by an average of 13% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

While the share price declined over five years, Shanghai Jinqiao Export Processing Zone DevelopmentLtd actually managed to increase EPS by an average of 13% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

The steady dividend doesn't really explain why the share price is down. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

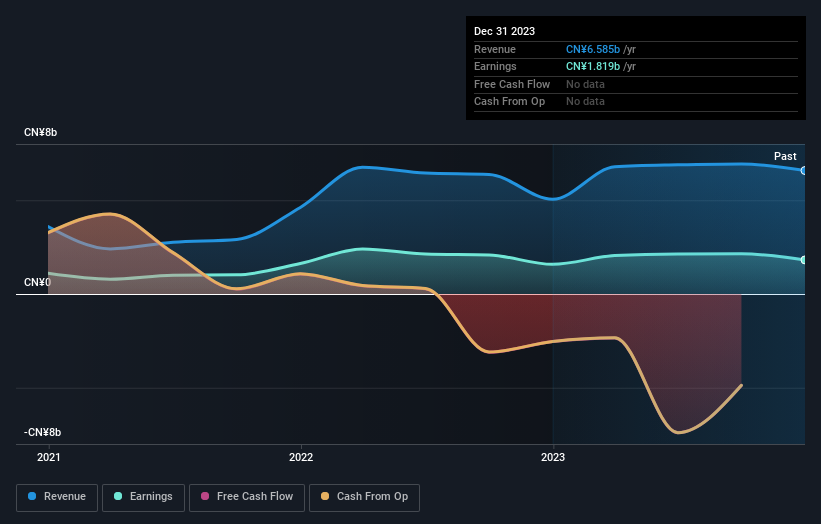

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Shanghai Jinqiao Export Processing Zone DevelopmentLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Shanghai Jinqiao Export Processing Zone DevelopmentLtd's TSR for the last 5 years was -14%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Shanghai Jinqiao Export Processing Zone DevelopmentLtd shareholders have received a total shareholder return of 1.9% over one year. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 3% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Shanghai Jinqiao Export Processing Zone DevelopmentLtd you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course Shanghai Jinqiao Export Processing Zone DevelopmentLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.