GRG Metrology & Test Group Co., Ltd. (SZSE:002967) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

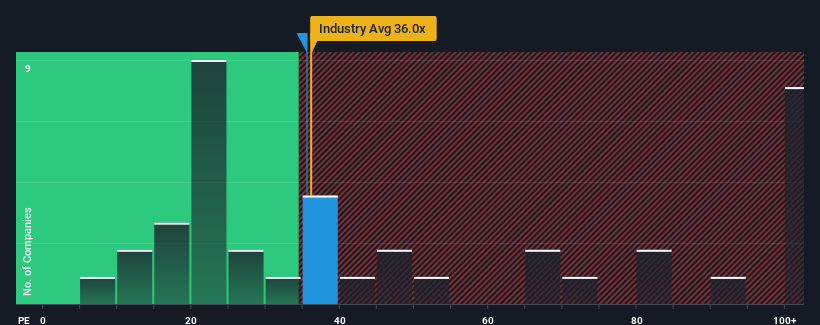

Following the firm bounce in price, GRG Metrology & Test Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 35.5x, since almost half of all companies in China have P/E ratios under 31x and even P/E's lower than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for GRG Metrology & Test Group as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like GRG Metrology & Test Group's to be considered reasonable.

There's an inherent assumption that a company should outperform the market for P/E ratios like GRG Metrology & Test Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. The solid recent performance means it was also able to grow EPS by 19% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 39% during the coming year according to the three analysts following the company. With the market predicted to deliver 40% growth , the company is positioned for a comparable earnings result.

With this information, we find it interesting that GRG Metrology & Test Group is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

The large bounce in GRG Metrology & Test Group's shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of GRG Metrology & Test Group's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for GRG Metrology & Test Group you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.