Shenzhen Investment Holdings Bay Area Development Company Limited (HKG:737) shares have continued their recent momentum with a 27% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.7% over the last year.

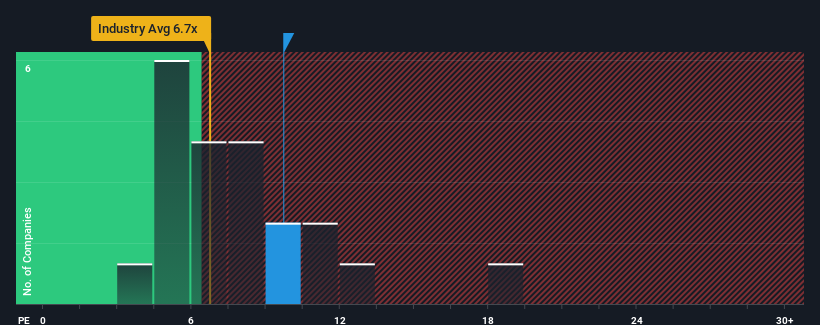

Even after such a large jump in price, there still wouldn't be many who think Shenzhen Investment Holdings Bay Area Development's price-to-earnings (or "P/E") ratio of 9.7x is worth a mention when the median P/E in Hong Kong is similar at about 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Shenzhen Investment Holdings Bay Area Development certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Is There Some Growth For Shenzhen Investment Holdings Bay Area Development?

In order to justify its P/E ratio, Shenzhen Investment Holdings Bay Area Development would need to produce growth that's similar to the market.

In order to justify its P/E ratio, Shenzhen Investment Holdings Bay Area Development would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 90% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 23% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 9.1% per year during the coming three years according to the one analyst following the company. With the market predicted to deliver 16% growth per year, that's a disappointing outcome.

With this information, we find it concerning that Shenzhen Investment Holdings Bay Area Development is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Shenzhen Investment Holdings Bay Area Development's P/E

Shenzhen Investment Holdings Bay Area Development appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shenzhen Investment Holdings Bay Area Development currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shenzhen Investment Holdings Bay Area Development, and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.