Tianjin Jieqiang Power Equipment Co.,Ltd. (SZSE:300875) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

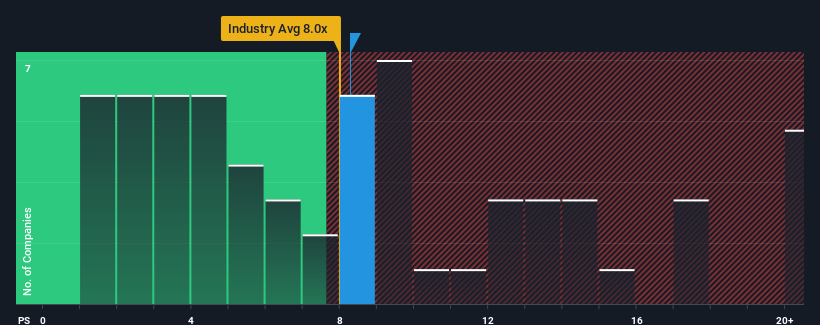

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Tianjin Jieqiang Power EquipmentLtd's P/S ratio of 8.3x, since the median price-to-sales (or "P/S") ratio for the Aerospace & Defense industry in China is also close to 8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Tianjin Jieqiang Power EquipmentLtd's P/S Mean For Shareholders?

Recent times have been quite advantageous for Tianjin Jieqiang Power EquipmentLtd as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tianjin Jieqiang Power EquipmentLtd's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Tianjin Jieqiang Power EquipmentLtd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tianjin Jieqiang Power EquipmentLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 141% last year. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 33% shows it's noticeably less attractive.

In light of this, it's curious that Tianjin Jieqiang Power EquipmentLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now Tianjin Jieqiang Power EquipmentLtd's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Tianjin Jieqiang Power EquipmentLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 2 warning signs for Tianjin Jieqiang Power EquipmentLtd you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.