The Zhejiang Zhaolong Interconnect Technology Co.,Ltd. (SZSE:300913) share price has done very well over the last month, posting an excellent gain of 39%. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

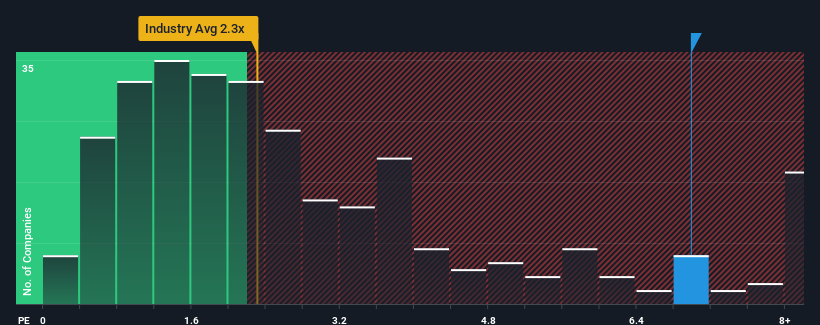

Following the firm bounce in price, you could be forgiven for thinking Zhejiang Zhaolong Interconnect TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Zhejiang Zhaolong Interconnect TechnologyLtd Performed Recently?

While the industry has experienced revenue growth lately, Zhejiang Zhaolong Interconnect TechnologyLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Zhaolong Interconnect TechnologyLtd will help you uncover what's on the horizon.How Is Zhejiang Zhaolong Interconnect TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Zhejiang Zhaolong Interconnect TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Even so, admirably revenue has lifted 31% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the only analyst following the company. With the industry predicted to deliver 24% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that Zhejiang Zhaolong Interconnect TechnologyLtd is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Zhejiang Zhaolong Interconnect TechnologyLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting Zhejiang Zhaolong Interconnect TechnologyLtd's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Zhejiang Zhaolong Interconnect TechnologyLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.