BOMESC Offshore Engineering Company Limited (SHSE:603727) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

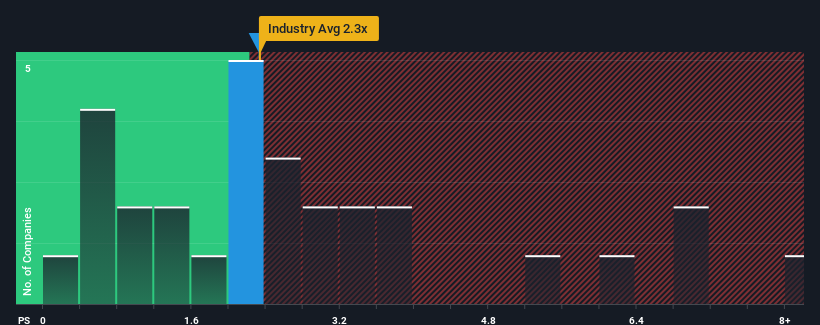

In spite of the firm bounce in price, it's still not a stretch to say that BOMESC Offshore Engineering's price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" compared to the Energy Services industry in China, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does BOMESC Offshore Engineering's P/S Mean For Shareholders?

BOMESC Offshore Engineering could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BOMESC Offshore Engineering.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like BOMESC Offshore Engineering's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 44%. This means it has also seen a slide in revenue over the longer-term as revenue is down 30% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 39% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that BOMESC Offshore Engineering's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From BOMESC Offshore Engineering's P/S?

BOMESC Offshore Engineering appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that BOMESC Offshore Engineering currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with BOMESC Offshore Engineering, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on BOMESC Offshore Engineering, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.