Unfortunately for some shareholders, the Cubic Digital Technology Co.,Ltd. (SZSE:300344) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

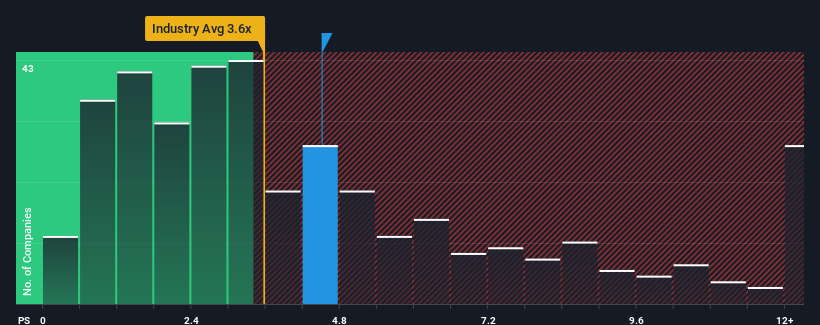

In spite of the heavy fall in price, given close to half the companies operating in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.6x, you may still consider Cubic Digital TechnologyLtd as a stock to potentially avoid with its 4.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Cubic Digital TechnologyLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Cubic Digital TechnologyLtd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cubic Digital TechnologyLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Cubic Digital TechnologyLtd?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Cubic Digital TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like Cubic Digital TechnologyLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 96% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Cubic Digital TechnologyLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

There's still some elevation in Cubic Digital TechnologyLtd's P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Cubic Digital TechnologyLtd revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Cubic Digital TechnologyLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.