Unfortunately for some shareholders, the Chipsea Technologies (shenzhen) Corp. (SHSE:688595) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

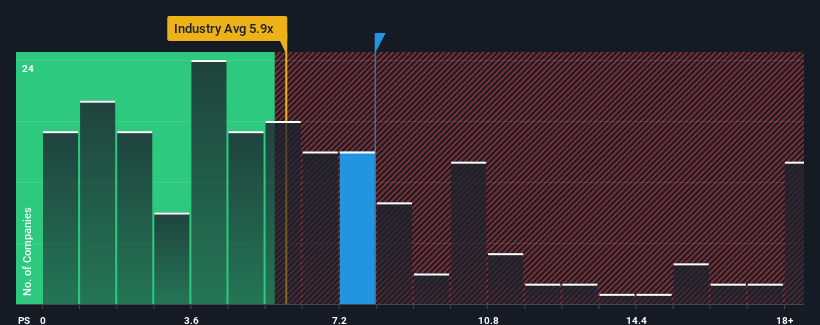

In spite of the heavy fall in price, Chipsea Technologies (shenzhen)'s price-to-sales (or "P/S") ratio of 8x might still make it look like a sell right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios below 5.9x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Has Chipsea Technologies (shenzhen) Performed Recently?

Chipsea Technologies (shenzhen) hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Chipsea Technologies (shenzhen)'s future stacks up against the industry? In that case, our free report is a great place to start.How Is Chipsea Technologies (shenzhen)'s Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Chipsea Technologies (shenzhen)'s to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like Chipsea Technologies (shenzhen)'s to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 30%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 39% per annum as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 29% per annum, which is noticeably less attractive.

With this information, we can see why Chipsea Technologies (shenzhen) is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

There's still some elevation in Chipsea Technologies (shenzhen)'s P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Chipsea Technologies (shenzhen) shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Chipsea Technologies (shenzhen) that you should be aware of.

If you're unsure about the strength of Chipsea Technologies (shenzhen)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.