Unfortunately for some shareholders, the Gansu Huangtai Wine-Marketing Industry Co.,Ltd (SZSE:000995) share price has dived 28% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

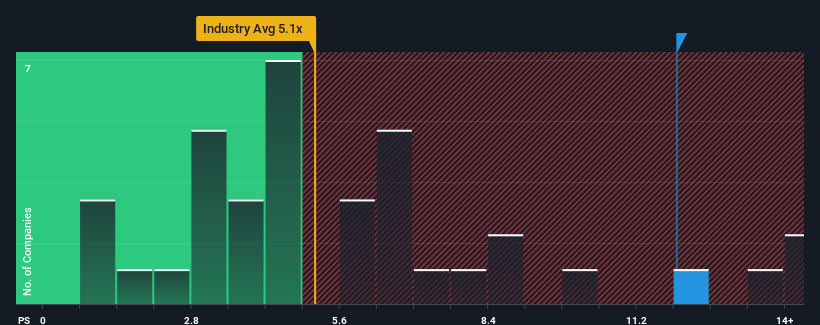

Even after such a large drop in price, when almost half of the companies in China's Beverage industry have price-to-sales ratios (or "P/S") below 5.1x, you may still consider Gansu Huangtai Wine-Marketing IndustryLtd as a stock not worth researching with its 12x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Gansu Huangtai Wine-Marketing IndustryLtd's P/S Mean For Shareholders?

For instance, Gansu Huangtai Wine-Marketing IndustryLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Gansu Huangtai Wine-Marketing IndustryLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Gansu Huangtai Wine-Marketing IndustryLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Gansu Huangtai Wine-Marketing IndustryLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Gansu Huangtai Wine-Marketing IndustryLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Gansu Huangtai Wine-Marketing IndustryLtd's P/S

Even after such a strong price drop, Gansu Huangtai Wine-Marketing IndustryLtd's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Gansu Huangtai Wine-Marketing IndustryLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Gansu Huangtai Wine-Marketing IndustryLtd with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.