Unfortunately for some shareholders, the Bafang Electric (Suzhou) Co.,Ltd. (SHSE:603489) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

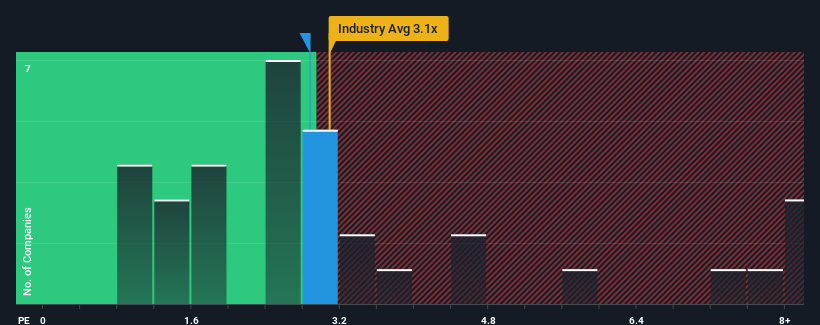

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Bafang Electric (Suzhou)Ltd's P/S ratio of 2.9x, since the median price-to-sales (or "P/S") ratio for the Leisure industry in China is also close to 3.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Bafang Electric (Suzhou)Ltd Has Been Performing

While the industry has experienced revenue growth lately, Bafang Electric (Suzhou)Ltd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Bafang Electric (Suzhou)Ltd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Bafang Electric (Suzhou)Ltd?

Bafang Electric (Suzhou)Ltd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's top line. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 19%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Bafang Electric (Suzhou)Ltd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for Bafang Electric (Suzhou)Ltd looks to be in line with the rest of the Leisure industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Bafang Electric (Suzhou)Ltd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Bafang Electric (Suzhou)Ltd has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If you're unsure about the strength of Bafang Electric (Suzhou)Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.