IAT Automobile Technology Co., Ltd. (SZSE:300825) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 20% in that time.

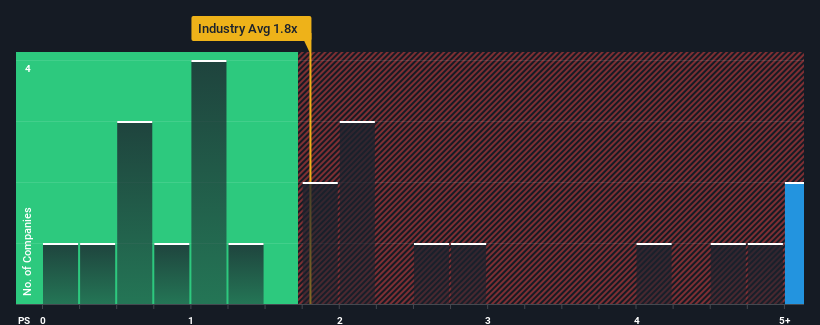

Even after such a large drop in price, when almost half of the companies in China's Auto industry have price-to-sales ratios (or "P/S") below 1.8x, you may still consider IAT Automobile Technology as a stock not worth researching with its 5.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has IAT Automobile Technology Performed Recently?

IAT Automobile Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on IAT Automobile Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For IAT Automobile Technology?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like IAT Automobile Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 158% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 64%, which is noticeably less attractive.

With this in mind, it's not hard to understand why IAT Automobile Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On IAT Automobile Technology's P/S

A significant share price dive has done very little to deflate IAT Automobile Technology's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into IAT Automobile Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for IAT Automobile Technology you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.