Raytron Technology Co.,Ltd. (SHSE:688002) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

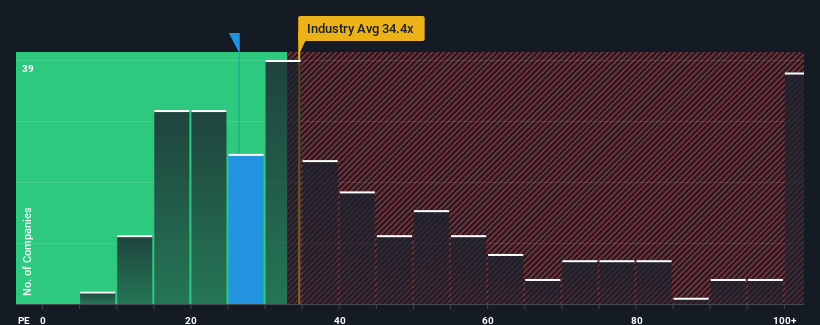

Even after such a large drop in price, it's still not a stretch to say that Raytron TechnologyLtd's price-to-earnings (or "P/E") ratio of 26.4x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 28x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Raytron TechnologyLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Raytron TechnologyLtd's is when the company's growth is tracking the market closely.

The only time you'd be comfortable seeing a P/E like Raytron TechnologyLtd's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 59% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 15% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 38% as estimated by the five analysts watching the company. That's shaping up to be similar to the 36% growth forecast for the broader market.

With this information, we can see why Raytron TechnologyLtd is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Following Raytron TechnologyLtd's share price tumble, its P/E is now hanging on to the median market P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Raytron TechnologyLtd's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Raytron TechnologyLtd with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Raytron TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.