The TianJin 712 Communication & Broadcasting Co., Ltd. (SHSE:603712) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

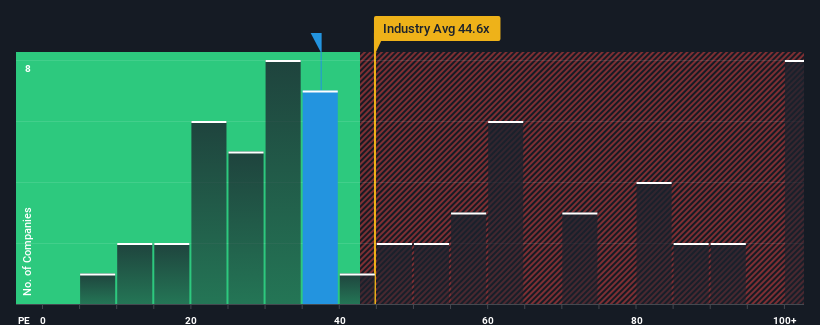

Even after such a large drop in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider TianJin 712 Communication & Broadcasting as a stock to potentially avoid with its 37.4x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

TianJin 712 Communication & Broadcasting could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is TianJin 712 Communication & Broadcasting's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like TianJin 712 Communication & Broadcasting's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 43% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 16% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 44% per annum over the next three years. With the market only predicted to deliver 21% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that TianJin 712 Communication & Broadcasting's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From TianJin 712 Communication & Broadcasting's P/E?

There's still some solid strength behind TianJin 712 Communication & Broadcasting's P/E, if not its share price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that TianJin 712 Communication & Broadcasting maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for TianJin 712 Communication & Broadcasting with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.