The Shenzhen Intellifusion Technologies Co., Ltd. (SHSE:688343) share price has fared very poorly over the last month, falling by a substantial 36%. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

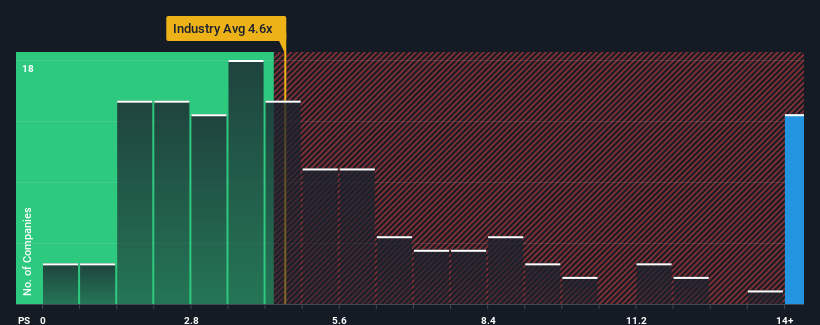

Although its price has dipped substantially, Shenzhen Intellifusion Technologies' price-to-sales (or "P/S") ratio of 18.6x might still make it look like a strong sell right now compared to other companies in the Software industry in China, where around half of the companies have P/S ratios below 4.6x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Shenzhen Intellifusion Technologies Performed Recently?

Shenzhen Intellifusion Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Intellifusion Technologies.How Is Shenzhen Intellifusion Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, Shenzhen Intellifusion Technologies would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Shenzhen Intellifusion Technologies would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 32% each year during the coming three years according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 23% per year, which is noticeably less attractive.

In light of this, it's understandable that Shenzhen Intellifusion Technologies' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

A significant share price dive has done very little to deflate Shenzhen Intellifusion Technologies' very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shenzhen Intellifusion Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Shenzhen Intellifusion Technologies is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.