Guangzhou Jinyi Media Corporation (SZSE:002905) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 22% share price drop.

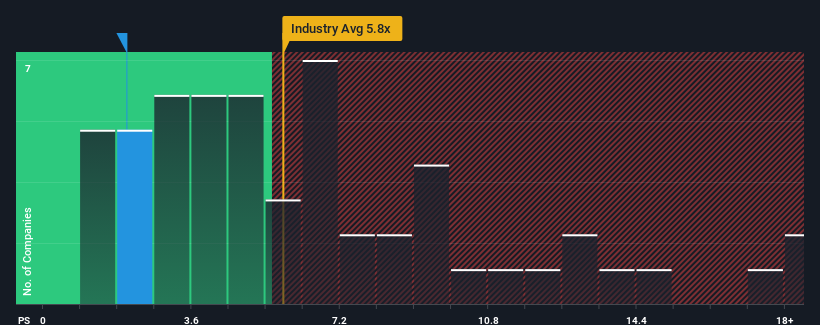

After such a large drop in price, Guangzhou Jinyi Media may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2x, considering almost half of all companies in the Entertainment industry in China have P/S ratios greater than 5.8x and even P/S higher than 9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Guangzhou Jinyi Media Has Been Performing

The revenue growth achieved at Guangzhou Jinyi Media over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangzhou Jinyi Media will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Guangzhou Jinyi Media's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 75% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 22% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Guangzhou Jinyi Media's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does Guangzhou Jinyi Media's P/S Mean For Investors?

Having almost fallen off a cliff, Guangzhou Jinyi Media's share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Guangzhou Jinyi Media currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Guangzhou Jinyi Media you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.