Unfortunately for some shareholders, the Shandong Polymer Biochemicals Co., Ltd. (SZSE:002476) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 32% share price drop.

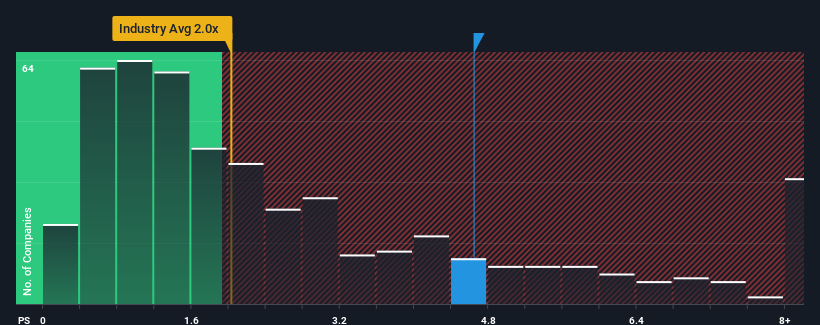

Even after such a large drop in price, you could still be forgiven for thinking Shandong Polymer Biochemicals is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.6x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Shandong Polymer Biochemicals Performed Recently?

For example, consider that Shandong Polymer Biochemicals' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shandong Polymer Biochemicals' earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shandong Polymer Biochemicals' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 21% shows it's noticeably less attractive.

In light of this, it's alarming that Shandong Polymer Biochemicals' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Shandong Polymer Biochemicals' P/S

Even after such a strong price drop, Shandong Polymer Biochemicals' P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shandong Polymer Biochemicals revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Shandong Polymer Biochemicals with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.