Transwarp Technology (Shanghai) Co.,Ltd. (SHSE:688031) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

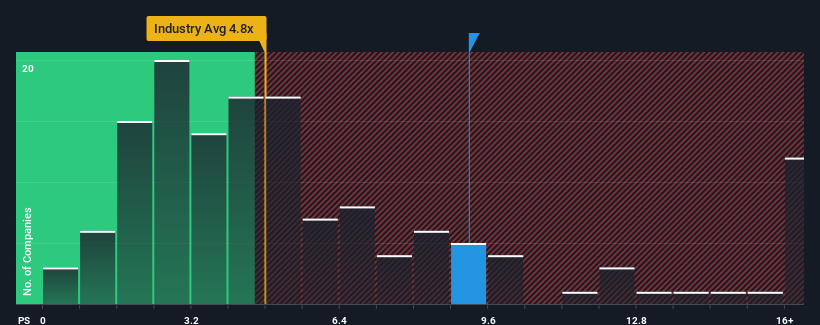

Even after such a large drop in price, Transwarp Technology (Shanghai)Ltd may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 9.2x, since almost half of all companies in the Software industry in China have P/S ratios under 4.8x and even P/S lower than 2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Transwarp Technology (Shanghai)Ltd's P/S Mean For Shareholders?

Recent times have been advantageous for Transwarp Technology (Shanghai)Ltd as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Transwarp Technology (Shanghai)Ltd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Transwarp Technology (Shanghai)Ltd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Transwarp Technology (Shanghai)Ltd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 44% last year. Pleasingly, revenue has also lifted 107% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 38% as estimated by the two analysts watching the company. With the industry only predicted to deliver 31%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Transwarp Technology (Shanghai)Ltd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, Transwarp Technology (Shanghai)Ltd's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Transwarp Technology (Shanghai)Ltd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Transwarp Technology (Shanghai)Ltd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.