To the annoyance of some shareholders, Sansheng Intellectual Education Technology CO.,LTD. (SZSE:300282) shares are down a considerable 55% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 83% share price decline.

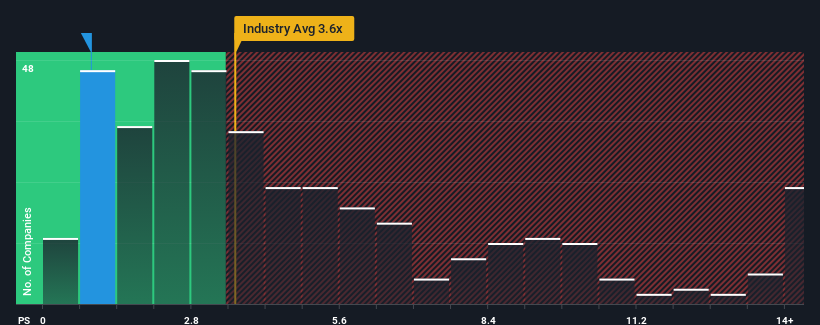

Following the heavy fall in price, Sansheng Intellectual Education TechnologyLTD may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.6x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does Sansheng Intellectual Education TechnologyLTD's Recent Performance Look Like?

For instance, Sansheng Intellectual Education TechnologyLTD's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Sansheng Intellectual Education TechnologyLTD will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sansheng Intellectual Education TechnologyLTD will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Sansheng Intellectual Education TechnologyLTD's to be considered reasonable.

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Sansheng Intellectual Education TechnologyLTD's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.9%. This means it has also seen a slide in revenue over the longer-term as revenue is down 39% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 26% shows it's an unpleasant look.

In light of this, it's understandable that Sansheng Intellectual Education TechnologyLTD's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Sansheng Intellectual Education TechnologyLTD's P/S Mean For Investors?

Sansheng Intellectual Education TechnologyLTD's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sansheng Intellectual Education TechnologyLTD confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Sansheng Intellectual Education TechnologyLTD you should be aware of, and 3 of them are potentially serious.

If these risks are making you reconsider your opinion on Sansheng Intellectual Education TechnologyLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.