The Huizhou Speed Wireless Technology Co.,Ltd. (SZSE:300322) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 19% in the last year.

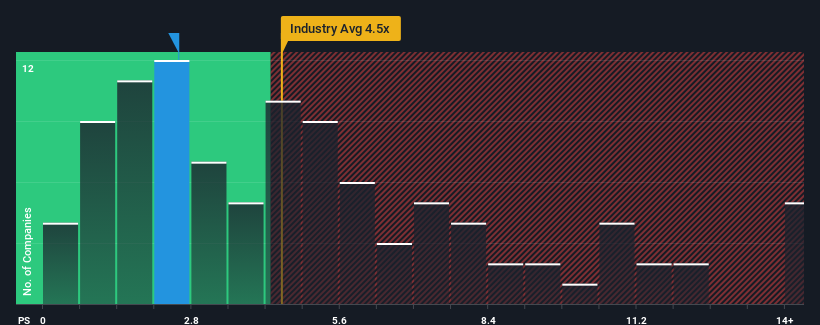

Since its price has dipped substantially, Huizhou Speed Wireless TechnologyLtd's price-to-sales (or "P/S") ratio of 2.6x might make it look like a buy right now compared to the Communications industry in China, where around half of the companies have P/S ratios above 4.5x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Huizhou Speed Wireless TechnologyLtd Has Been Performing

Huizhou Speed Wireless TechnologyLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Huizhou Speed Wireless TechnologyLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Huizhou Speed Wireless TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Huizhou Speed Wireless TechnologyLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Huizhou Speed Wireless TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Still, lamentably revenue has fallen 17% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 49% shows it's an unpleasant look.

With this in mind, we understand why Huizhou Speed Wireless TechnologyLtd's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Huizhou Speed Wireless TechnologyLtd's P/S?

Huizhou Speed Wireless TechnologyLtd's recently weak share price has pulled its P/S back below other Communications companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Huizhou Speed Wireless TechnologyLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Huizhou Speed Wireless TechnologyLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.