Key Insights

- Winning Tower Group Holdings' Annual General Meeting to take place on 8th of May

- CEO Eldon Lai's total compensation includes salary of HK$1.40m

- The total compensation is 43% less than the average for the industry

- Winning Tower Group Holdings' total shareholder return over the past three years was 77% while its EPS grew by 12% over the past three years

Shareholders will be pleased by the impressive results for Winning Tower Group Holdings Limited (HKG:8362) recently and CEO Eldon Lai has played a key role. At the upcoming AGM on 8th of May, they will get a chance to hear the board review the company results, discuss future strategy and cast their vote on any resolutions such as executive remuneration. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

How Does Total Compensation For Eldon Lai Compare With Other Companies In The Industry?

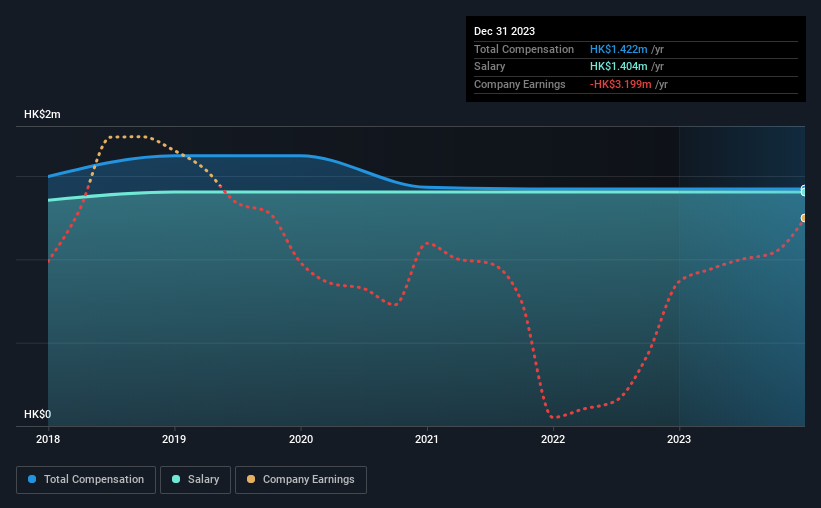

According to our data, Winning Tower Group Holdings Limited has a market capitalization of HK$87m, and paid its CEO total annual compensation worth HK$1.4m over the year to December 2023. This was the same amount the CEO received in the prior year. We note that the salary portion, which stands at HK$1.40m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the Hong Kong Consumer Retailing industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$2.5m. This suggests that Eldon Lai is paid below the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$1.4m | HK$1.4m | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$1.4m | HK$1.4m | 100% |

Talking in terms of the industry, salary represented approximately 73% of total compensation out of all the companies we analyzed, while other remuneration made up 27% of the pie. Winning Tower Group Holdings is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Winning Tower Group Holdings Limited's Growth Numbers

Over the past three years, Winning Tower Group Holdings Limited has seen its earnings per share (EPS) grow by 12% per year. It achieved revenue growth of 16% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Winning Tower Group Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Winning Tower Group Holdings Limited for providing a total return of 77% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Eldon receives almost all of their compensation through a salary. Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Winning Tower Group Holdings (of which 2 are potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.