Jiangsu Liance Electromechanical Technology Co., Ltd.'s (SHSE:688113) healthy profit numbers didn't contain any surprises for investors. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

Examining Cashflow Against Jiangsu Liance Electromechanical Technology's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

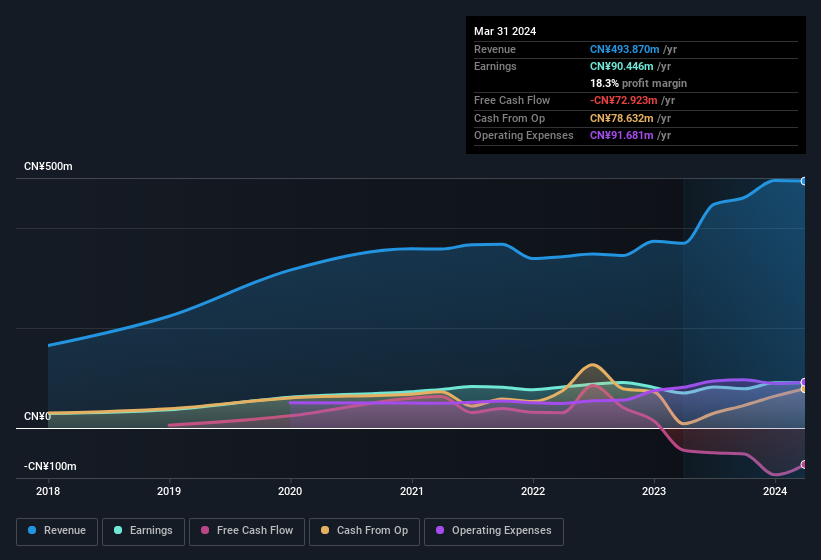

For the year to March 2024, Jiangsu Liance Electromechanical Technology had an accrual ratio of 0.29. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, raising questions about how useful that profit figure really is. Even though it reported a profit of CN¥90.4m, a look at free cash flow indicates it actually burnt through CN¥73m in the last year. We also note that Jiangsu Liance Electromechanical Technology's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥73m.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Jiangsu Liance Electromechanical Technology.

Our Take On Jiangsu Liance Electromechanical Technology's Profit Performance

Jiangsu Liance Electromechanical Technology didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Therefore, it seems possible to us that Jiangsu Liance Electromechanical Technology's true underlying earnings power is actually less than its statutory profit. The good news is that, its earnings per share increased by 30% in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. At Simply Wall St, we found 2 warning signs for Jiangsu Liance Electromechanical Technology and we think they deserve your attention.

Today we've zoomed in on a single data point to better understand the nature of Jiangsu Liance Electromechanical Technology's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.