Financial giants have made a conspicuous bullish move on $ServiceNow (NOW.US)$. Our analysis of options history for ServiceNow revealed 24 unusual trades.

Delving into the details, we found 54% of traders were bullish, while 12% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $83,237, and 22 were calls, valued at $1,137,944.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $600.0 to $1140.0 for ServiceNow during the past quarter.

Insights into Volume & Open Interest

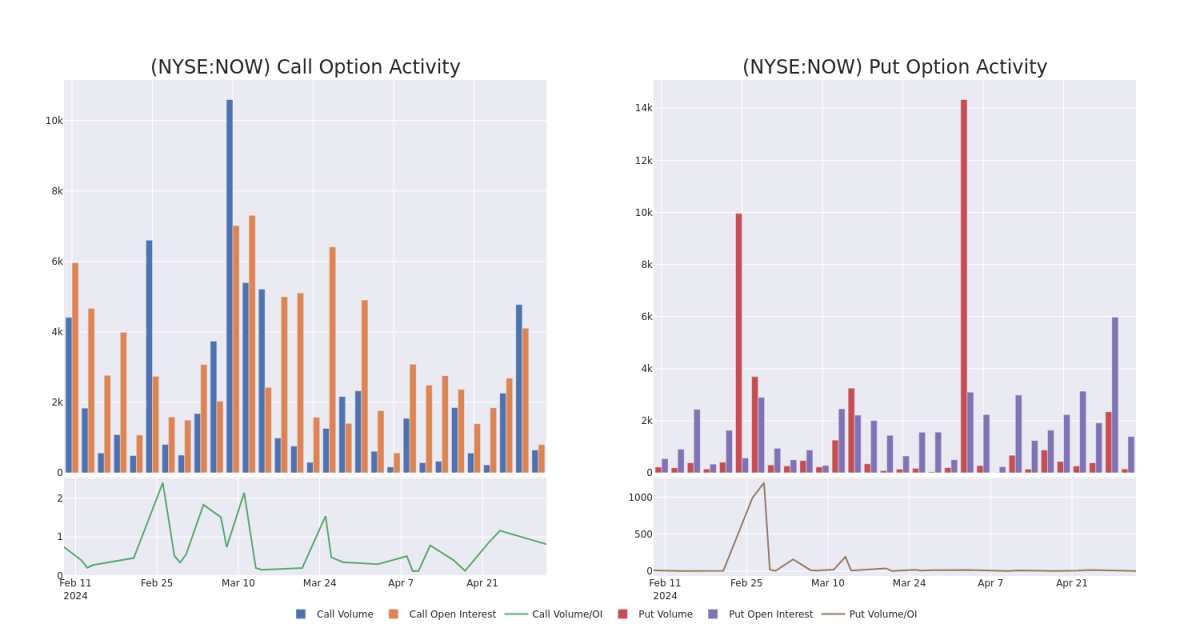

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for ServiceNow's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ServiceNow's whale activity within a strike price range from $600.0 to $1140.0 in the last 30 days.

ServiceNow Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

NOW | CALL | SWEEP | BULLISH | 05/17/24 | $26.0 | $23.8 | $26.0 | $710.00 | $156.0K | 315 | 60 |

NOW | CALL | TRADE | BULLISH | 05/17/24 | $26.0 | $23.8 | $25.6 | $710.00 | $153.6K | 315 | 0 |

NOW | CALL | TRADE | BULLISH | 05/17/24 | $26.4 | $24.8 | $26.0 | $710.00 | $91.0K | 315 | 125 |

NOW | CALL | TRADE | BULLISH | 05/17/24 | $128.9 | $119.0 | $125.22 | $600.00 | $75.1K | 22 | 6 |

NOW | CALL | SWEEP | BULLISH | 11/15/24 | $73.9 | $72.0 | $73.9 | $740.00 | $73.9K | 22 | 10 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

In light of the recent options history for ServiceNow, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of ServiceNow

With a volume of 565,262, the price of NOW is up 1.1% at $724.55.

RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

Next earnings are expected to be released in 79 days.

Expert Opinions on ServiceNow

5 market experts have recently issued ratings for this stock, with a consensus target price of $895.0.

Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on ServiceNow with a target price of $900.

An analyst from Jefferies has decided to maintain their Buy rating on ServiceNow, which currently sits at a price target of $900.

Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $900.

In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $825.

An analyst from Keybanc has decided to maintain their Overweight rating on ServiceNow, which currently sits at a price target of $950.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.