Guizhou Aviation Technical Development Co., Ltd (SHSE:688239) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

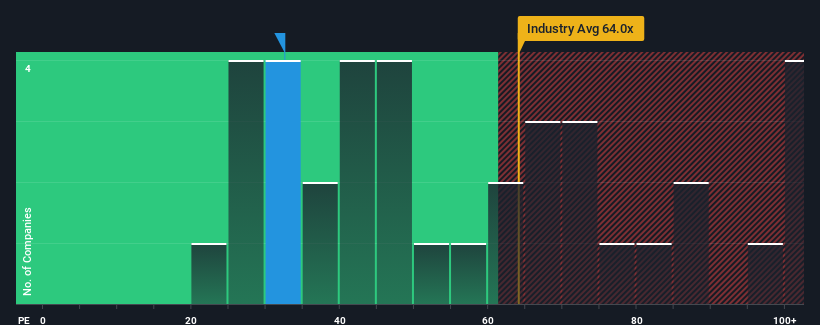

In spite of the firm bounce in price, it's still not a stretch to say that Guizhou Aviation Technical Development's price-to-earnings (or "P/E") ratio of 32.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Guizhou Aviation Technical Development could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Guizhou Aviation Technical Development would need to produce growth that's similar to the market.

In order to justify its P/E ratio, Guizhou Aviation Technical Development would need to produce growth that's similar to the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. However, a few strong years before that means that it was still able to grow EPS by an impressive 82% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 42% each year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 25% per annum growth forecast for the broader market.

With this information, we find it interesting that Guizhou Aviation Technical Development is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Guizhou Aviation Technical Development's P/E

Guizhou Aviation Technical Development's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Guizhou Aviation Technical Development's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Guizhou Aviation Technical Development you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.