Shenzhen Quanxinhao Co., Ltd. (SZSE:000007) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 2.5% isn't as attractive.

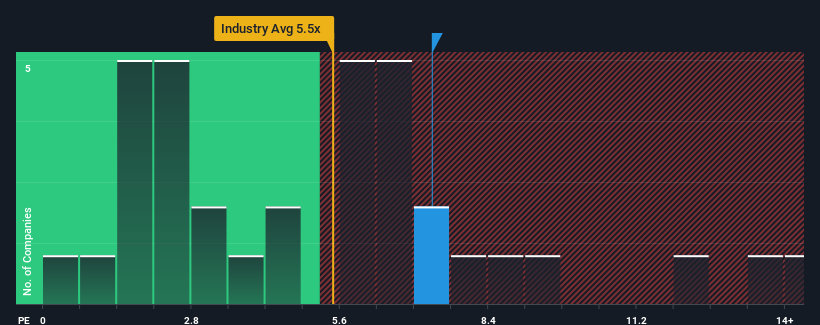

Since its price has surged higher, Shenzhen Quanxinhao may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 7.3x, since almost half of all companies in the Hospitality in China have P/S ratios under 5.5x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Shenzhen Quanxinhao's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Shenzhen Quanxinhao over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen Quanxinhao's earnings, revenue and cash flow.How Is Shenzhen Quanxinhao's Revenue Growth Trending?

Shenzhen Quanxinhao's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Shenzhen Quanxinhao's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 2.4% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

When compared to the industry's one-year growth forecast of 18%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Shenzhen Quanxinhao's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Shenzhen Quanxinhao's P/S

The large bounce in Shenzhen Quanxinhao's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Shenzhen Quanxinhao can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Shenzhen Quanxinhao with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.