Those holding Ko Yo Chemical (Group) Limited (HKG:827) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

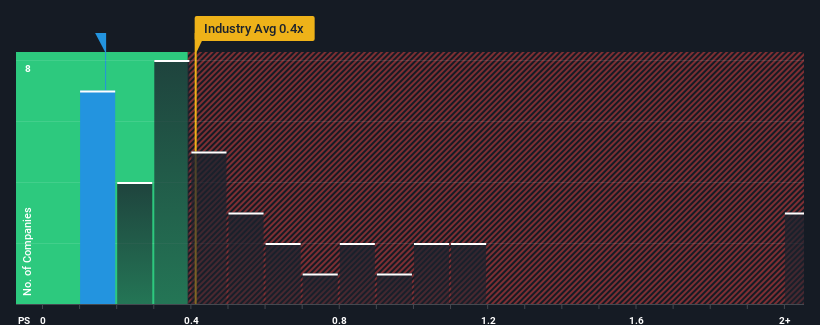

Although its price has surged higher, you could still be forgiven for feeling indifferent about Ko Yo Chemical (Group)'s P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in Hong Kong is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Ko Yo Chemical (Group) Has Been Performing

As an illustration, revenue has deteriorated at Ko Yo Chemical (Group) over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Ko Yo Chemical (Group) will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Ko Yo Chemical (Group)?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ko Yo Chemical (Group)'s to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ko Yo Chemical (Group)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.4% decrease to the company's top line. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 36% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Ko Yo Chemical (Group)'s P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Its shares have lifted substantially and now Ko Yo Chemical (Group)'s P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Ko Yo Chemical (Group)'s average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you take the next step, you should know about the 2 warning signs for Ko Yo Chemical (Group) that we have uncovered.

If these risks are making you reconsider your opinion on Ko Yo Chemical (Group), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.