Shenandoah Telecommunications Company (NASDAQ:SHEN) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.1% in the last twelve months.

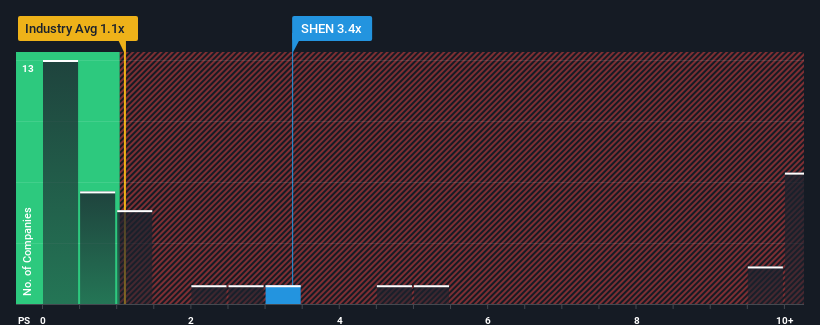

Following the firm bounce in price, given around half the companies in the United States' Telecom industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Shenandoah Telecommunications as a stock to avoid entirely with its 3.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Shenandoah Telecommunications' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Shenandoah Telecommunications has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenandoah Telecommunications.How Is Shenandoah Telecommunications' Revenue Growth Trending?

In order to justify its P/S ratio, Shenandoah Telecommunications would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.2%. The solid recent performance means it was also able to grow revenue by 27% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 26% during the coming year according to the two analysts following the company. With the industry predicted to deliver 43% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Shenandoah Telecommunications' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Shenandoah Telecommunications' P/S?

Shenandoah Telecommunications' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Shenandoah Telecommunications trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You need to take note of risks, for example - Shenandoah Telecommunications has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you're unsure about the strength of Shenandoah Telecommunications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.