Despite an already strong run, Qingdao Huicheng Environmental Technology Group Co., Ltd. (SZSE:300779) shares have been powering on, with a gain of 54% in the last thirty days. The last 30 days bring the annual gain to a very sharp 46%.

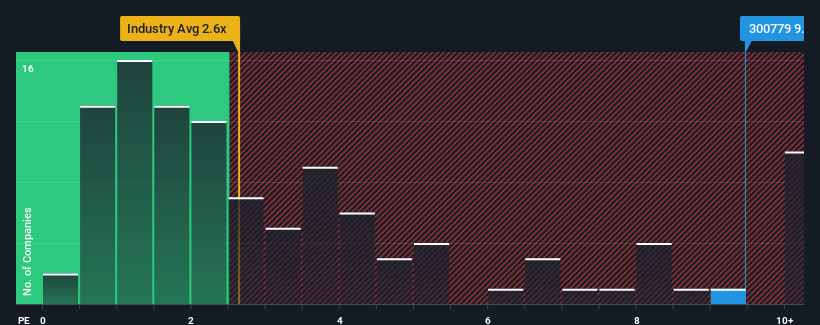

After such a large jump in price, you could be forgiven for thinking Qingdao Huicheng Environmental Technology Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.5x, considering almost half the companies in China's Commercial Services industry have P/S ratios below 2.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Qingdao Huicheng Environmental Technology Group's Recent Performance Look Like?

Qingdao Huicheng Environmental Technology Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Qingdao Huicheng Environmental Technology Group will help you uncover what's on the horizon.How Is Qingdao Huicheng Environmental Technology Group's Revenue Growth Trending?

Qingdao Huicheng Environmental Technology Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 104%. The latest three year period has also seen an excellent 256% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 55% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 30% growth forecast for the broader industry.

With this information, we can see why Qingdao Huicheng Environmental Technology Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Qingdao Huicheng Environmental Technology Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Qingdao Huicheng Environmental Technology Group shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Qingdao Huicheng Environmental Technology Group is showing 3 warning signs in our investment analysis, and 1 of those can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.