If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Zhejiang Wolwo Bio-Pharmaceutical Co., Ltd. (SZSE:300357) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 65% drop in the share price over that period. And more recent buyers are having a tough time too, with a drop of 38% in the last year.

After losing 7.2% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Zhejiang Wolwo Bio-Pharmaceutical actually saw its earnings per share (EPS) improve by 1.0% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

It looks to us like the market was probably too optimistic around growth three years ago. However, taking a look at other business metrics might shed a bit more light on the share price action.

The modest 0.8% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 6.8% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Zhejiang Wolwo Bio-Pharmaceutical more closely, as sometimes stocks fall unfairly. This could present an opportunity.

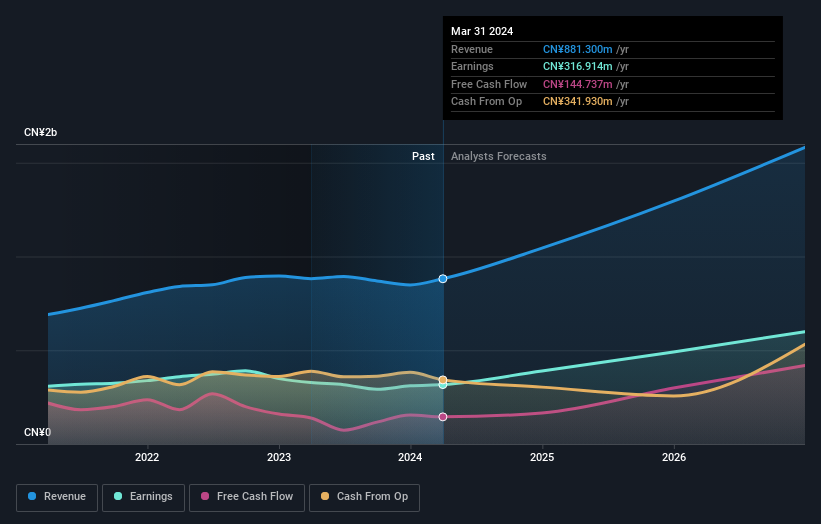

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Zhejiang Wolwo Bio-Pharmaceutical shareholders are down 37% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 10%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Zhejiang Wolwo Bio-Pharmaceutical , and understanding them should be part of your investment process.

Of course Zhejiang Wolwo Bio-Pharmaceutical may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.